Intraday trading, the fast-paced world of buying and selling stocks within a single trading day, can be an exciting and potentially profitable endeavor. But for the uninitiated, navigating this dynamic market can be daunting. A crucial element for success in intraday trading is selecting the right stocks – those with the potential for price movements that allow you to capitalize on short-term opportunities.

This guide delves into the key factors to consider when choosing stocks for intraday trading, equipping you with the knowledge to make informed decisions and potentially enhance your trading experience.

Understanding Intraday Trading:

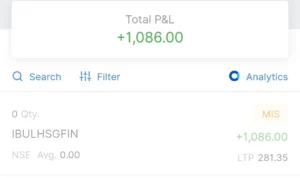

Before we dive into stock selection, let’s establish a clear understanding of intraday trading. Unlike long-term investors who focus on a company’s fundamentals and hold stocks for extended periods, intraday traders capitalize on price fluctuations within a single trading day. They aim to buy low and sell high, profiting from these short-term movements.

This strategy requires active participation, with traders constantly monitoring market movements, news, and technical indicators to identify potential opportunities.

Key Considerations for Stock Selection:

Now that we’ve set the stage, let’s explore the fundamental aspects to consider when selecting stocks for intraday trading:

1. Liquidity:

Liquidity refers to the ease with which a stock can be bought and sold without significantly impacting its price. In intraday trading, where timing is crucial, liquidity is paramount.

Focus on High-Volume Stocks: Look for stocks with a high average daily trading volume (number of shares traded per day). This ensures you can enter and exit positions quickly without substantial price movements triggered by your own trades.

Identify Actively Traded Stocks: Popular stocks with a large following tend to have higher liquidity. These stocks often experience more frequent price fluctuations, offering potential opportunities for intraday traders.

2. Volatility:

Volatility refers to the extent to which a stock’s price fluctuates. While some stability is desirable, intraday traders seek stocks with a certain degree of volatility to capitalize on price swings.

Analyze Historical Volatility: Look at the stock’s historical volatility through technical indicators like Average True Range (ATR) or standard deviation. This helps gauge the stock’s typical price movements within a day.

Consider Sector Trends: Certain sectors, like technology or biotechnology, are inherently more volatile than others. Focus on sectors experiencing news-driven events or undergoing significant changes, as these can lead to increased price fluctuations.

Be Cautious of Excessive Volatility: While volatility offers opportunities, excessive price swings can also lead to rapid losses. Develop a risk management strategy to mitigate potential downside.

3. Market Trends:

Understanding the overall market direction can significantly impact your intraday trading decisions.

Align with the Market Trend: If the market is trending upwards (bullish), look for stocks that are likely to benefit from this momentum. Conversely, during a downtrend (bearish), identify stocks potentially experiencing weakness.

Identify Countertrend Opportunities: While aligning with the overall trend is a good strategy, skilled traders can also identify countertrend opportunities. These involve buying stocks in a downtrend if they show signs of reversal or short-selling stocks in an uptrend if they appear overbought.

4. News and Events:

Company-specific news announcements, industry developments, or broader economic events can significantly impact stock prices.

Stay Updated with News: Monitor news feeds and financial websites for relevant news events that might affect your chosen stocks.

React Quickly to News: Be prepared to react swiftly to news that could trigger price movements. However, avoid impulsive decisions; analyze the news’ potential impact before taking action.

Consider Upcoming Events: Look at the company’s or industry’s upcoming events calendar. Earnings reports, product launches, or regulatory decisions can influence stock prices.

5. Technical Analysis:

Technical analysis involves studying historical price and volume data to identify trading opportunities. While not a foolproof method, it can provide valuable insights into potential price movements.

Utilize Technical Indicators: Employ technical indicators like moving averages, relative strength index (RSI), or Bollinger Bands to identify support and resistance levels, potential breakouts, and overbought/oversold conditions.

Combine Technical with Other Factors: Don’t rely solely on technical indicators. Combine them with your understanding of market trends, news events, and the company’s fundamentals.

Developing Your Intraday Trading Strategy:

Once you understand the factors influencing stock selection, it’s crucial to develop a trading strategy that aligns with your risk tolerance and trading style.

Define Your Risk Tolerance: Intraday trading can be risky. Determine your risk tolerance and the maximum amount you’re willing to lose per trade. Implement stop-loss

Very interesting points you have mentioned, regards for putting up.Raise blog range