The U.S. stock market offers a vast landscape for investors and traders. For beginners, navigating this landscape can be daunting. Two popular short-term trading styles are intraday trading and swing trading. Understanding the differences between these approaches can help you decide which might be a better fit for your goals and resources.

What is Intraday Trading?

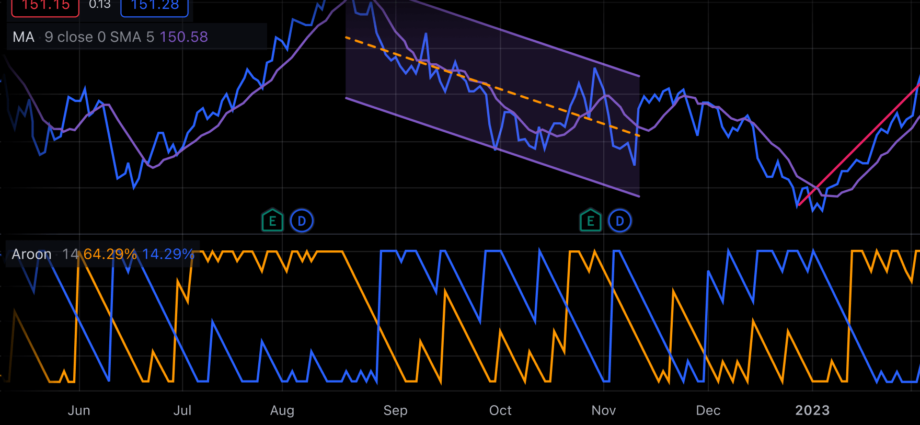

Intraday trading, also known as day trading, involves opening and closing positions within the same trading day. Day traders capitalize on short-term price movements throughout the day, aiming to profit from market volatility. They rely on technical analysis to identify trading opportunities, using charts and indicators to predict price movements.

Pros of Intraday Trading:

- Potential for high profits: Intraday trading offers the chance to capture significant gains in a short period.

- Quick results: You know your results by the end of the day, providing a sense of closure.

- No overnight risk: Positions aren’t held overnight, eliminating exposure to potential gaps in price after market hours.

Cons of Intraday Trading:

- High time commitment: Intraday trading requires constant monitoring of the market throughout the trading day.

- Stressful: The fast-paced nature and potential for quick losses can be stressful for beginners.

- Requires significant capital: Frequent trading can deplete capital quickly, especially with commissions.

- Advanced skills needed: Successful intraday trading demands a deep understanding of technical analysis and risk management.

What is Swing Trading?

Swing trading involves holding positions for a timeframe ranging from days to weeks, capitalizing on price swings that occur over a longer period. Swing traders use a combination of technical and fundamental analysis to identify trading opportunities. Technical analysis helps them find entry and exit points, while fundamental analysis helps them assess the underlying value of the asset.

Pros of Swing Trading:

- More flexibility: Swing trading requires less time commitment compared to intraday trading.

- Less stressful: The longer time horizon can lead to a more relaxed trading experience.

- Lower capital requirements: Swing traders typically make fewer trades, reducing commission costs.

- Suitable for beginners: Swing trading allows for more time to research and analyze potential trades before entering the market.

Cons of Swing Trading:

- Slower profits: Profits accumulate over a longer period compared to intraday trading.

- Overnight risk: Positions are exposed to potential price gaps and market events after hours.

- Requires patience: Swing traders need to be patient and wait for their trades to play out.

Here’s a table summarizing the key differences:

| Feature | Intraday Trading | Swing Trading |

|---|---|---|

| Timeframe | Same day | Days to Weeks |

| Number of Trades | Frequent | Less Frequent |

| Technical Analysis | Highly Important | Important |

| Fundamental Analysis | Less Important | Can be Important |

| Time Commitment | High | Moderate |

| Stress Level | High | Lower |

| Capital Requirements | High | Lower |

| Risk Management | Crucial | Crucial |

Choosing Between Intraday and Swing Trading

The best approach for you depends on your individual circumstances. Consider the following factors:

- Available Time: Intraday trading requires significant time commitment, while swing trading allows for more flexibility.

- Risk Tolerance: Intraday trading carries a higher degree of risk due to the fast-paced nature.

- Capital: Intraday trading typically requires more starting capital due to frequent trades and potential commissions.

- Personality: Some traders thrive in the fast-paced environment of intraday trading, while others prefer the more patient approach of swing trading.

Here are some additional tips for beginners:

- Educate yourself: Before entering the market, thoroughly research trading strategies, risk management techniques, and the psychology of trading.

- Start with a paper trading account: Paper trading allows you to practice your strategies and get comfortable with the market without risking real capital.

- Focus on risk management: Develop a solid risk management plan that includes stop-loss orders and position sizing to limit potential losses.

- Be patient: Don’t expect overnight success. Trading takes time, discipline, and consistent learning.

- Start small: Begin with a small amount of capital to minimize potential losses while you gain experience.

Finding Resources in the USA

The USA offers a wealth of resources for aspiring traders. Here are a few to get you started:

- Securities and Exchange Commission (SEC): https://www.sec.gov/ – Provides educational resources on investing and trading.

- Financial Industry Regulatory Authority (FINRA): https://www.finra.org/ – Offers investor education and resources on choosing

I was reading some of your posts on this site and I think this web site is rattling instructive!

Continue putting up.Raise range